During Analyst Day in Seoul on November 6 mentioned in a previous post, Samsung also unveiled its strategy vision about the consumer electronics (CE). This fact together with the recent problems of some European home appliances manufacturers has made me think about some considerations.

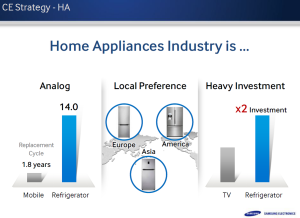

Samsung focus on the difficult Home Appliances Market highlighting that Home Appliances Industry is led by a quite long replacement Cycle (eg 14 years for refrigerators) with local preferences for design and features and with heavy investment effort (eg twice the refrigerator for TVs).

About the washing machines Samsung identifies the points on which to spend its effort:

If we are going to see the performance as for European the European companies are performing well, in fact faced by leaders both for

performance and for energy and water saving.

Below a comparative analysis constructed from the nameplate data for some products sold in a European Union Country (Italy). To be taken into account that the data were taken from the websites of the respective manufacturers (Italy or Germany) and because of

the fact that not all are accurate in the same way some inaccuracies may be present, for detail

please consider the local sites and the most recent specification.

Even at the level of other features the European companies maintain standards and high levels offering special features such as the case of Miele with its famous honeycomb drum, which on closer inspection was the forerunner of more environmentally friendly-clothes drums and now even approached by other companies. Obviously, in this my very brief analysis can not take into account the actual cleaning quality that can be done only with special tests.

As seen in the above list Samsung presents in its current offer a smart solution with its Smart Check with which you can solve the most common problems without a technician using a photo of the code shown on the display of the washing machine to get the information about the problem and the actions to take to resolve it.

In another model (model WF12F9E6P4W), not considered in the table above, where I tried to put the flagship products but with the same capacity figures, Samsung shows the Smart Wi-Fi solution that allows you to control and monitor the status of remote the washing machine using an app (at the moment on iOS and Android). Wherever you are if you are connecting to a wireless network you can start or pause the wash cycle of your selections, remaining time and end time.

Taking into account the current paradigms of household appliances I would say that the smart solutions integration between the mobile world and appliances is not yet (at the very moment I speaking) a mandatory requirement from consumers. This is even truer in the case of the mainstream segment, but being now that Samsung could be considered a trend maker the European flagship products have to consider the Smart world. Currently the feeling of perceived quality is not only related to performance and specific features of the product but also the ability to be in ine with the new trends. So, although the focus at the moment can be kept on the “classic” features such as washing, consumption, care of clothes, European industry cannot afford to miss the smart solution innovation train.

The discussion above I consider very relevant mainly for ” non-premium ” Companies that have to try to take advantage of this new trend to not risk further problems.

Of course, while Samsung can take advantage of the fact that a business conglomerate that also embraces the telecom and information technology (think about the aggressive policies Samsung that combines a smartphone for some washing machines), European industry must seek to create integrated applications or HW devices in a more creative and perhaps more effort.